Aren’t you tired of being too busy? You might be overextending yourself by working 12-hour days and performing every aspect of running a real estate business - while squeezing in time with family. It might feel like you’re drowning in work, barely keeping your head above water. Since you’re spreading yourself too thin, you might provide a poor experience for your clients, since you’re unable to give them the time and attention they deserve. Don’t they deserve the best?

Plus, businesses are reopening and yours might be experiencing a flood of buyers as if a dam burst. If your market hasn’t experienced an increase in sales, it will as consumers regain spending confidence. According to a HousingWire article, “U.S. Pending home sales surged a record 44% in May.” We should see similar increases as summer progresses, which means your flood of work is only to rise.

But hey, it’s better to drown in work than to have no work at all, right? True, but you can have a heavy workload without feeling like you’re drowning, and you don’t have to sacrifice your personal life or your family to succeed as a real estate professional. You can have it all, just work smarter.

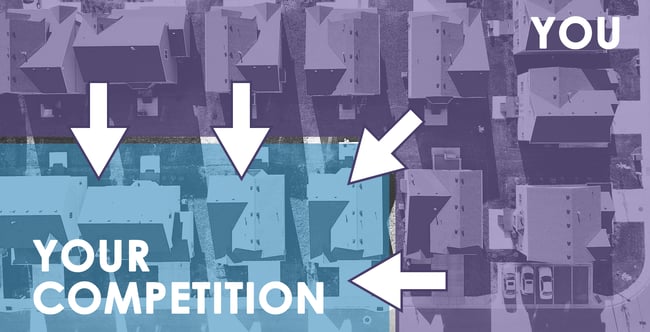

If you’re drowning in work, can’t give your clients the attention they deserve, and can’t find free time for yourself or your family, that’s a good indicator it’s time to scale your real estate business. Why? By scaling your business, you can reassess your processes and create the infrastructure necessary to properly manage and facilitate its growth. If you scale successfully, you’ll increase your income, have more time for clients, family, or yourself, exert less energy on less important tasks, and ultimately increase your market share in your area.

In this article, I will share ways to evaluate your business, provide tools to help you forecast and project your real estate business’s growth, and offer tips for planning for the future:

- How to Forecast Your Real Estate Business’s Annual Sales Growth

- How to Forecast Your Real Estate Business's Expenses

- How to Forecast Your Real Estate Business’s Profits

- Download the Sales Growth, Expenses and Profits Forecast Calculator to help you forecast sales growth and revenue over 5 years >>>

How to Evaluate Your Real Estate Business and Plan To Scale

To begin scaling your business, you must evaluate your real estate business and its historical information first. By reviewing your past sales, expenses, amount of work/hours spent working, task priorities, and marketing metrics like page visits/clicks/conversions, you can assess your numbers to forecast your future performance. Since your historical information is the foundation for forecasting your future sales/profits, your projections will be more accurate if they are more detailed and thorough.

1. How to Forecast Your Real Estate Business’s Annual Sales Growth

Let’s say you’ve been in the real estate business for 3 years. You have three years of performance data like sales, expenses, profits, and marketing metrics that you can use to forecast the future. To get the most accurate data, use your month performance data and its sum to determine your annual performance.

To calculate Sales Growth, we need to calculate 4 amounts:

- # of Services Sold: The amount of monthly home buyer transactions, home seller transactions, and other ancillary services you provide that produce cash flow like referral bonuses, homeowner’s insurance, home improvement, etc.

- Average Price of Service: The average income earned from each transaction and service you provide by month.

- Average Price of Service = (Price of Transaction 1 + Price of Transaction 2 +…..)/ # of Transactions

- Revenue: The amount of income earned.

- Revenue = # of Services Sold x Average Price of Service

- Average Revenue Growth Rate: The percentage of sales growth based on the previous year

- Average Revenue Growth Rate = (Historical Year 2 Revenue/Historical Year 1 Revenue) -1

After you’ve determined your Average Sales Growth Rate, you can use it as a constant for growth to forecast the amount of potential future revenue. For example, if you earned $1,000,000 of Revenue in Historical Year 1 and $1,100,000 in Historical Year 2, your Average Sales Growth Rate would be 10%. To forecast Year 1’s Revenue, simply multiple Historical Year 2’s Revenue by the Average Sales Growth Rate 10%, then add the result to Historical Year 2’s Revenue:

- Year 1’s Revenue Forecast = (Historical Year 2’s Revenue x Average Sales Growth Rate) + Historical Year 2’s Revenue

- $1,331,000 = ($1,210,000 x .1) + $1,210,000

Finally, complete these steps for Year 2 through 5:

- Year 2’s Revenue Forecast: $1,464,100 = ($1,331,000 x .1) + $1,331,000

- Year 3’s Revenue Forecast: $1,610,510 = ($1,464,100 x .1) + $1,464,100

- Year 4’s Revenue Forecast: $1,771,561 = ($1,610,510 x .1) + $1,610,510

- Year 5’s Revenue Forecast: $1,948717 = ($1,771,561 x .1) + $1,771,561

Therefore, your real estate business’s revenue would increase by $617,717 over 5 years at a constant growth rate of 10% and $1,100,000 base revenue.

Since real estate is highly influenced by seasons, use the difference between monthly growth rates instead of the annual growth rates to calculate projections more accurately (March Historic Year 2 – March Historic Year 1 = March Sales Growth Rate).

Based on this information, you can determine the amount of monthly and annual transactions and their average prices required to hit a certain revenue or growth goal.

2. How to Forecast Your Real Estate Business’s Expenses

Your business expenses are the costs associated with running your real estate business. Your should have a separate bank account to keep your business and personal costs split up – it’s much easier to manage and track your budget this way.

The most accurate way to forecast your expenses is by following a similar process as the Sales Growth Forecast step above. First, calculate your historical monthly expenses for the past 2 years. If certain fees are paid annually, divide them by 12 months to calculate the monthly expense. Then compare the historical expenses for Historical Year 1 and Historical Year 2 to calculate your Expenses Growth Rate:

- Expenses Growth Rate = (Historical Year 2 Expenses/Historical Year 1 Expenses) – 1

Once you’ve calculated the Expenses Growth Rate, you can use it to calculate the Expense Forecast for Year 1:

- Year 2 Expenses Forecast = (Year 1 Expenses x Expenses Growth Rate) - 1

Alternatively, you can estimate your Monthly Expenses and Expense Growth Rate to calculate a less accurate 5-year Expense Forecast. Note: If you choose to estimate your Expenses Growth Rate, it is better to overstate and have extra budget than it is to understate have run out of budget early.

Some real estate business expense include costs associated with: office overhead, phone, vehicle, productivity software, marketing, education, training, commissions paid out, business meals, travel for work, general business, licenses, fees, and other expenses that help you do your job. Again, be as detailed, accurate and as thorough as you can if you want to the most accurate forecast. Many of these business expenses are tax deductible, so you get receive a hefty tax refund by tracking your spending in detail and reporting it the IRS on your taxes.

With this information, you can properly budget, find the necessary amount of funding, etc. over the next 5 years.

3.How to Forecast Your Real Estate Business’s Profits

After you’ve calculated your Sales Growth and Expense Forecasts, you can use those results to estimate your Profits Forecast. Your Profits Forecast can be calculated by subtracting your Expenses from your Revenue. By creating a 5-year Profits Forecast, you can paint a picture and more accurately predict the growth of your real estate business.

Before you draft a plan to scale your business, you must first evaluate your historical performance so you can forecast your real estate business’s potential growth more accurately. To evaluate your historical performance data, gather 2 years of past sales performance to determine your Sales Growth Rate, and 2 years of past expenses to determine your Expense Growth Rate. Use these growth rates to forecast your potential Profits over 5 years. Once you’ve determined your Profits Forecast, use the results to plan your budget, set monthly/annual transactions objectives, and project the average service price needed to accomplish your scaling goals!